Historic Druid Hills

In the late 1880's Joel Hurt, a prominent Atlanta developer and businessman, had a vision for creating a second residential suburb in Altanta, Druid Hills. He hired Frederick Law Olmsted, Sr. architect of Central Park in NYC, South Park in Chicago, Prospect Park in Brooklyn, and the grounds of the Capitol in Washington, D.C. Olmsted created broad, curving streets divided by a major avenue with a succession of public parks in the median, bordered by large estates. The final work was completed in 1936. Olmstead's design strongly influenced much of the early planning around Atlanta proper. Some of the most distinguished early 20th-century architects practicing in Atlanta designed houses in Druid Hills, including Walter T. Downing, Arthur Neal Robinson, Henry Hornbostel and Neil Reid. Many of these architects would later create Ansley Park, Morningside, Garden Hills and Avondale Estates. Coke magnet Asa Candler and his family, John Ray Patillo, president of the Patillo Lumber Company, and William D. Thompson, dean of the Emory University Law school were among the early residents. Emory University, recognized internationally for its outstanding liberal arts colleges, graduate and professional schools, and one of the Southeast's leading health care systems, is located on a beautiful, leafy campus in historic Druid Hills. Keep up with the latest news in Druid Hills, www.druidhills.org.

Half Year 2015 Sales Statistics

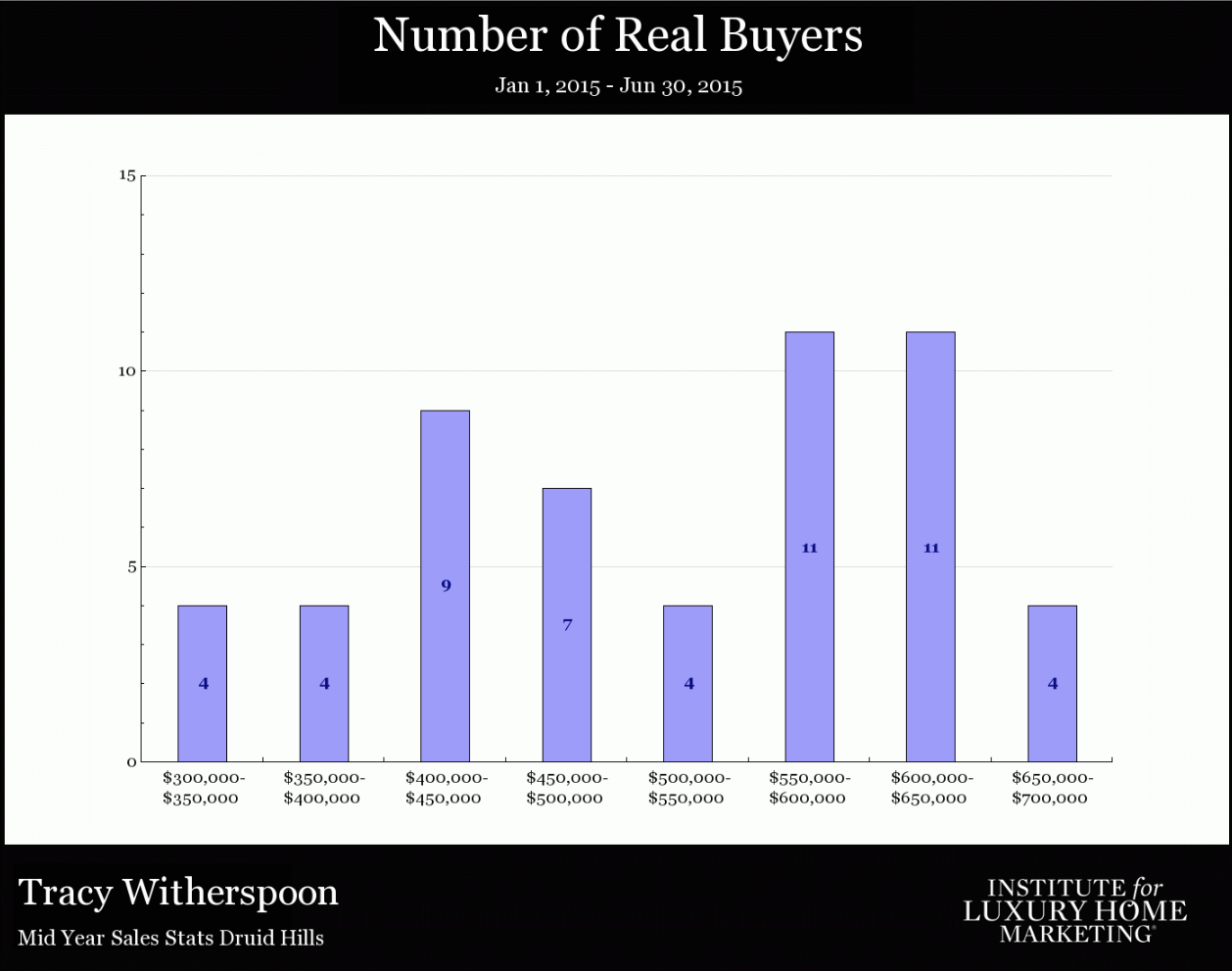

Homes sold 83

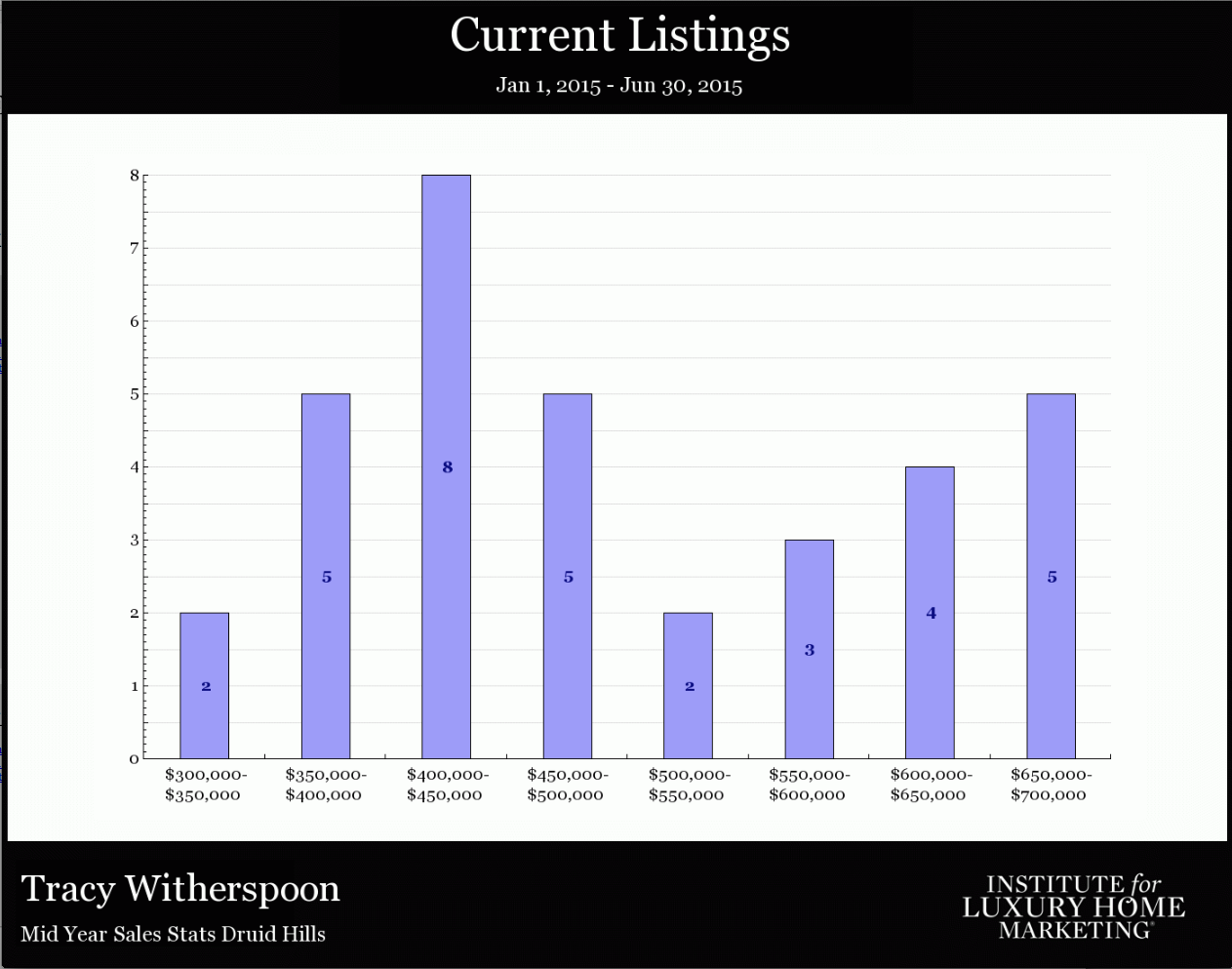

Active listings 60

Price range 2.25 million-$253K

Average sales price $661,942

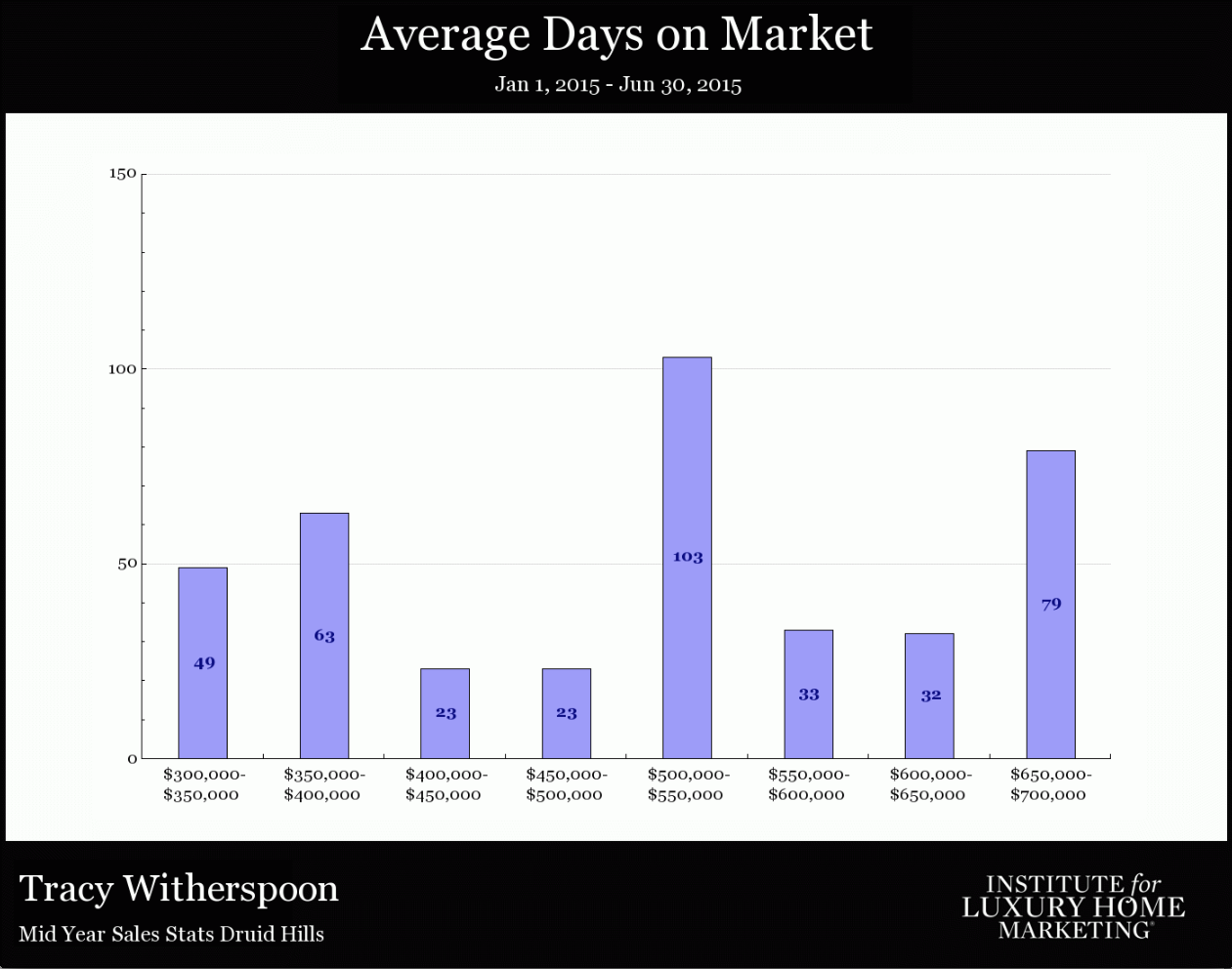

Average days on market 57

Percentage of sales price to list price 95.84%

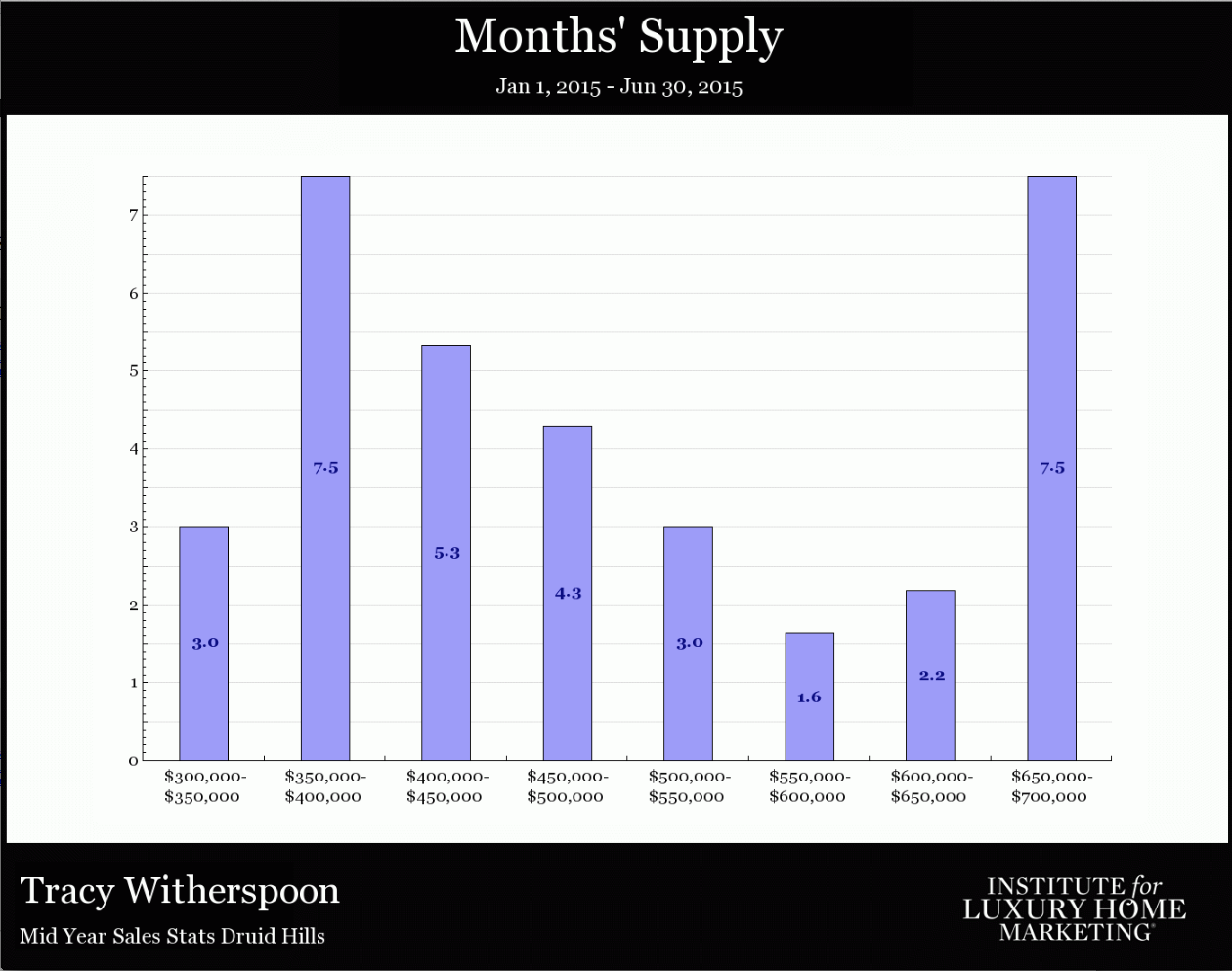

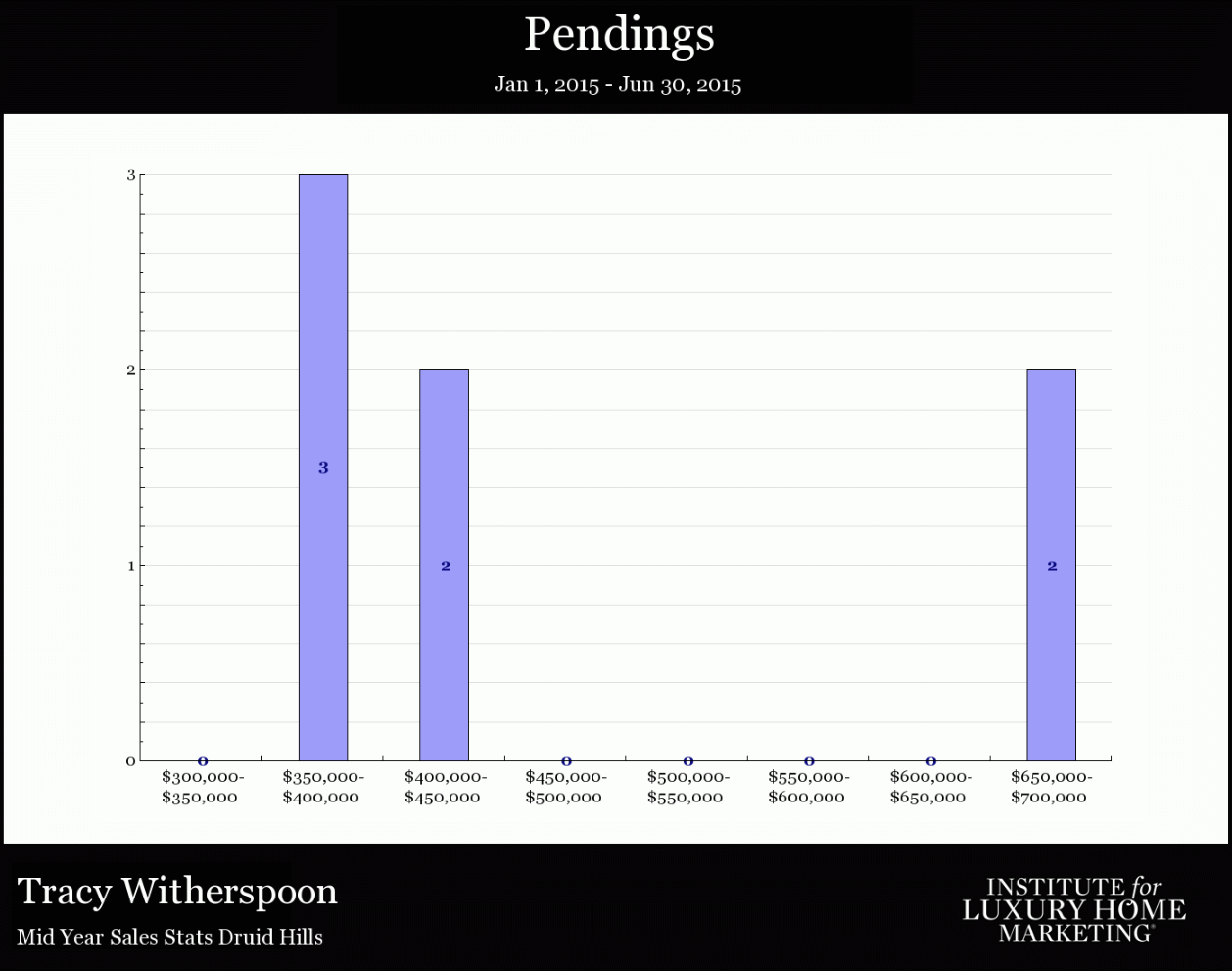

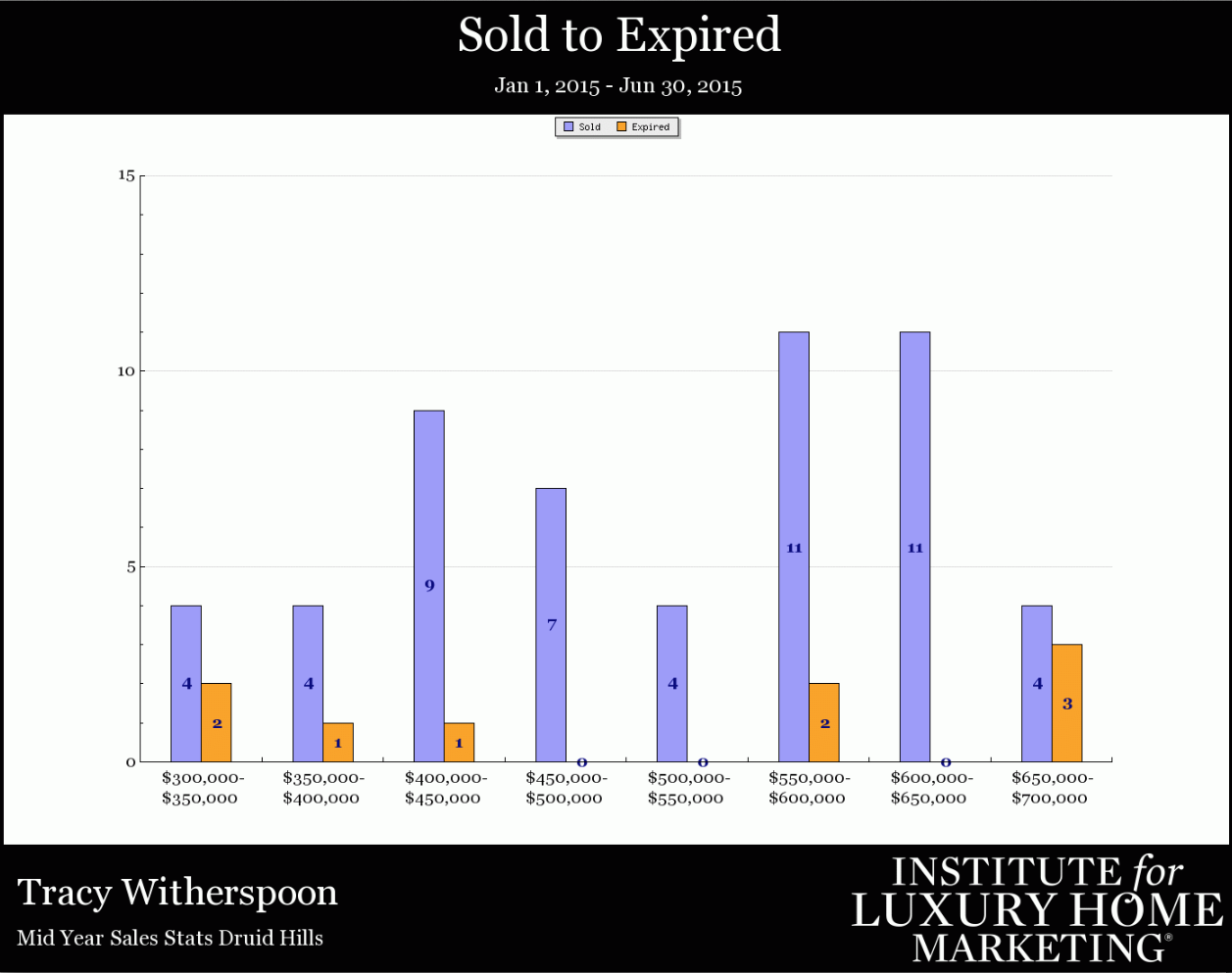

Want a more indepth summary broken out by price range? You'll find it below

Property Taxes Unincorporated Dekalb county

"Is it cheaper to live in Dekalb, Fulton or one of the incorperated areas? Great question. Our answer is that calculating your specific property taxes within any of these areas is contingent upon so many factors that without knowing the specific property, the many possible homestead exemptions for which you may qualify, the government's budget for that area for the current year, what percentage of the assessed values they use to calculate property taxes (40% or 50%) the services they provide or utilize from another source and finally the indiviual mill rates for each service, we are hard pressed to give you an answer. What we suggest is that you consider the governmental services that are important to you, the strength of those in your areas of interest and let that be a part of your purchasing decision.

Note: Georgia bill SB436 requires that the purchase price of your new home be used as the fair market value in the year following the purchase. DeKalb County collects a 1% sales tax (HOST) used to reduce property taxes. 85% of the money collected goes towards increasing the homestead exemption. Only owner occupied homes get this credit, there is a big difference in taxes in DeKalb County between owner occupied homes and rental homes

HOMESTEAD EXEMPTIONs-The government wants to give you money

remember to file postmarked by april 1, 2015

A homestead exemption helps you save on taxes on your home. An exemption removes part of the fair market value of your property from taxation and lowers your taxes. In Georgia, Real property is assessed at 40%. For example, if your home is assessed at $100,00 and you qualify for a $40,000 exemption, you pay taxes on your home as if it were worth $60,000. There are additional exemptions for Seniors, Veterans with disabilities and disabled civilians. Check with you county or city for the details and forms.

Schools: Dekalb County Public School District Website, Fernbank Elementary, Druid Hills Middle School, Druid Hills High School

The Ben Franklin Academy, Frazier Center, The Paideia School